(b) A member who is or will be absent from a members’ meeting may vote by mail or by an approved alternative method on the ballot prescribed in this subdivision on any motion, resolution, or amendment that the board submits for vote by mail or alternative method to the members. A member’s vote at a members’ meeting shall be in person or by mail if a mail vote is authorized by the board or by alternative method if authorized by the board and not by proxy, except as provided in subdivision 4. A member or delegate may exercise voting rights on any matter that is before the members as prescribed in the articles or bylaws at a members’ meeting from the time the member or delegate arrives at the members’ meeting, unless the articles or bylaws specify an earlier and specific time for closing the right to vote. Nothing in this section must be construed to limit the power of the cooperative to indemnify persons other than a director, chief executive officer, member, employee, or member of a committee of the board of the cooperative by contract or otherwise. When written action is permitted to be taken by less than all directors, all directors must be notified immediately of its text and effective date. A director who does not sign or consent to the written action has no liability for the action or actions taken by the written action.

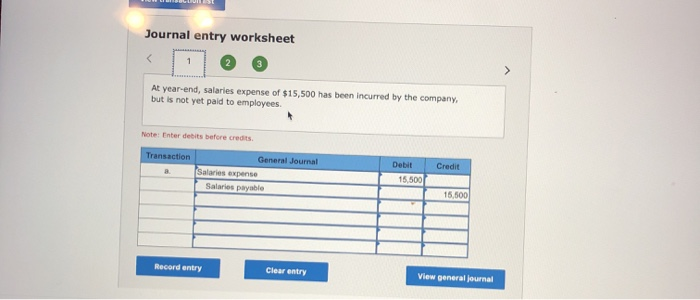

- On the other hand, an accrued expense is an event where a company has acquired an obligation to pay an amount to someone else but has not yet done so.

- (6) for a consolidation, the plan shall contain the articles of the entity or organizational documents to be filed with the state in which the entity is organized or, if the surviving organization is a Minnesota limited liability company, the articles of organization.

- A restriction is not binding with respect to membership interests issued prior to the adoption of the restriction, unless the holders of those membership interests are parties to the agreement or voted in favor of the restriction.

- “Patron membership interest” means the membership interest requiring the holder to conduct patronage business for or with the cooperative, as specified by the cooperative to receive financial rights or distributions.

- A waiver of notice by a director entitled to notice is effective whether given before, at, or after the meeting, and whether given in writing, orally, or by attendance.

Subd. 12.Filed with the secretary of state.

Unless otherwise provided in the articles or bylaws, a would-be contributor’s rights under a contribution agreement may not be assigned, in whole or in part, to a person who was not a member at the time of the assignment, unless all the members approve the assignment by unanimous written consent. The authorized amount and divisions of patron membership interests and, if authorized, nonpatron membership interests may be increased, decreased, established, or altered, in accordance with the restrictions in this chapter by amending the articles or bylaws at a regular members’ meeting or at a special members’ meeting called for the purpose of the amendment. (e) An appointment of a proxy for membership interests owned jointly by two or more members is valid if signed or consented to by authenticated electronic communication, by any one of them, unless the cooperative receives from any one of those members written notice or an authenticated electronic communication either denying the authority of that person to appoint a proxy or appointing a different proxy. The board may fix a date not more than 60 days, or a shorter time period provided in the articles or bylaws, before the date of a meeting of members as the date for the determination of the owners of membership interests entitled to notice of and entitled to vote at the meeting.

How Do Accrued Liabilities Work for a Company?

The contract may allow the cooperative to sell or resell the product of its patron member or patron with or without taking title to the product, and pay the resale price to the patron member or patron, after deducting all necessary selling, overhead, and other costs and expenses, including other proper reserves and interest. (b) A cooperative may take, receive, and hold real and personal property, including the principal and interest of money or other funds and rights in a contract, in trust for any purpose not inconsistent with the purposes of the cooperative in its articles or bylaws and may exercise fiduciary powers in relation to taking, receiving, and holding the real and personal property. Accrued expenses are generally short-term expenses that will be paid within a month of when they are incurred. If we expect to pay them within a year, we’ll note them on the balance sheet as current liabilities.

.627 MEMBER CONTROL AGREEMENTS.

When the expense is paid through the Accounts Payable module, you’ll credit the Expense account item. When the invoice arrives and is paid, the bookkeeper then enters the software’s if an expense has been incurred but will be paid later, then: Accounts Payable section and credits the General Ledger $1,500. At the same time, the accrued expenses liability account is debited $1,500 because the account is paid in full.

A company with a bond will accrue interest expense on its monthly financial statements even though interest on bonds is typically paid semi-annually. The interest expense recorded in an adjusting journal entry will be the amount that’s accrued as of the financial statement date. An accountant usually marks a debit to the company’s expense account and a credit to its accrued liability account. This is then reversed when the next accounting period begins and the payment is made.

Membership interests of a cooperative reflected in the required records as being owned by another domestic or foreign business entity may be voted by the chair, chief executive officer, or another legal representative of that organization. A patron member of a cooperative is only entitled to one vote on an issue to be voted upon by members holding patron membership interests, except that if authorized in the articles or bylaws a patron member may be entitled to additional votes based on patronage criteria in section 308B.551. On any matter of the cooperative, the entire patron members voting power shall be voted collectively based upon the vote of the majority of patron members voting on the issue and the collective vote of the patron members shall be a majority of the vote cast unless otherwise provided in the bylaws.

Participation in a meeting by that means constitutes presence in person at the meeting. (b) A cooperative may purchase, own, and hold ownership interests, including stock and other equity interests, memberships, interests in nonstock capital, and evidences of indebtedness of any domestic business entity or foreign business entity. (a) A cooperative may purchase and hold, lease, mortgage, encumber, sell, exchange, and convey as a legal entity real, personal, and intellectual property, including real estate, buildings, personal property, patents, and copyrights as the business of the cooperative may require, including the sale or other disposition of assets required by the business of the cooperative as determined by the board. (a) Bylaws shall be adopted before any distributions to members, but if the articles or bylaws provide that rights of contributors to a class of membership interest will be determined in the bylaws, then the bylaws must be adopted before the acceptance of any contributions to that class. “Foreign cooperative” means a foreign business entity organized to conduct business on a cooperative plan consistent with this chapter or chapter 308A.

The delegates may only exercise the voting rights on a basis and with the number of votes as prescribed in the articles or bylaws. To the extent authorized in the articles or the bylaws and determined by the board, a member not physically present in person or by proxy at a regular or special meeting of members may, by means of remote communication, participate in a meeting of members held at a designated place. The cooperative shall give notice of a special members’ meeting by mailing the special members’ meeting notice to each member personally at the person’s last known post office address or an alternative method approved by the board and the member individually or the members generally. For a member that is an entity, notice mailed or delivered by an alternative method shall be to an officer of the entity.