ETFs are marketable securities by definition because they are traded on public exchanges. The assets held by exchange-traded funds may themselves be marketable securities, such as stocks in the Dow Jones. However, ETFs may also hold assets that are not marketable securities, such as gold and other precious metals. Non-marketable securities are highly illiquid assets that do not trade on prominent secondary exchanges.

- A ratio above one indicates the assets are greater than the liabilities.

- It reveals how well a company can meet its debt and other obligations, and can be used to make comparisons between peers.

- Here is a snapshot from the 2017 Annual Report of The Coca Cola Company.

- Another requirement of marketable security has a strong secondary market, which allows for quick turnarounds of the marketable securities.

- There is a direct correlation between an insurance company’s assets and its income, as evidenced by the Prudential income statement and balance sheet.

What Are the Safest Types of Marketable Securities?

While marketable securities offer a range of benefits, there are also some downsides to consider. All marketable securities are subject to market risk, meaning that their value can fluctuate based on market conditions. This can lead to losses for investors, even those who hold “safer” marketable securities even for a short period of time. The current ratio depicts how well a company can pay off its short-term obligations with its current assets. What this ratio reveals is how much of a company’s current liabilities can be covered by its current cash and short-term assets.

Learning Accounting

Marketable securities can also come in the form of money market instruments, derivatives, and indirect investments. Without an easily accessible market that investors and buy and sell securities on, a financial instrument is consider a non-marketable security. Marketable securities are defined as investments with short-term maturities that can be easily sold on public exchanges such as the Nasdaq and NYSE. Before we answer that question, let us look at another marketable securities example.

Exchange-Traded Funds (ETFs)

For corporations, marketable securities serve as a cash management tool. Companies use them to earn returns on excess cash while maintaining the flexibility to quickly access funds when needed. On balance sheets, marketable securities are typically classified when is the earliest you can file your tax return as current assets because of their high liquidity. The reason that marketable securities are highly liquid is that the maturities tend to be less than a year. Also, the rates at which they can be sold or bought don’t have much of an effect on the prices.

Are marketable securities current assets?

However, most companies have a low cash ratio since holding too much cash or investing heavily in marketable securities is not a highly profitable strategy. However, instead of holding on to all the cash in its coffers which presents no opportunity to earn interest, a business will invest a portion of the cash in short-term liquid securities. This way, instead of having cash sit idly, the company can earn returns on it. If a sudden need for cash emerges, the company can easily liquidate these securities. Examples of a short-term investment products are a group of assets categorized as marketable securities.

Preferred shares have the benefit of fixed dividends that are paid before the dividends to common stockholders, which makes them more like bonds. In the event of financial difficulties, bonds may continue to receive interest payments while preferred share dividends remain unpaid. These are useful assets for a company to own because they can be easily sold when the business needs to get cash quickly. Marketable securities are also used when calculating liquidity ratios like the cash ratio, current ratio, and quick ratio.

Such securities include savings bonds, limited partnership or private company shares, and complex derivatives. A stock can be quickly sold even in a declining market, though potentially at a loss. The essential characteristic is the ability to quickly convert the asset to cash, not the direction of price movement. Investing in complex financial companies such as insurance companies requires understanding the business and the different jargon and layout of financial statements. The vast majority of marketable securities on the balance sheet are fair value.

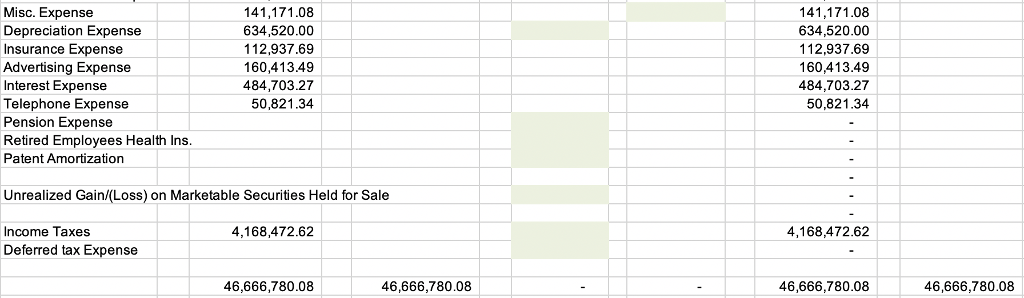

The investing section of the statement always shows the cash used to purchase securities or the cash received from the sale of securities. For example, when marketable securities are sold at a gain, the cash inflow from the sale would be denoted on the cash flow statement. Marketable securities, particularly trading securities, are recorded at the time they are sold. This is the primary location where they are noted and they are listed as an asset. Usually, the securities are stated at fair market value as of the date of the financial statements.